October 11, 2012

Although discussion about the State of Illinois’ annual budget primarily focuses on the operating expenditures the State also appropriates significant funding each year for capital investments. The State approved a $22.7 billion capital budget for FY2013 that is not part of the $33.0 billion General Funds budget enacted for operations.

Since FY2005, the State’s capital budget and operating budget have been recommended as separate documents by the Governor and considered in separate budget bills by the General Assembly. Unlike the State’s operating budget, which generally requires that all appropriated funds be spent in the same year they are approved, capital appropriations must be reauthorized over multiple years as planning, engineering and construction of capital investments commences. The total spending approved in the FY2013 capital budget includes funding from the State, as well as grants from the federal government and local matching funds to pay for projects.

As previously discussed here, the Governor’s recommended FY2013 capital budget was not made widely available to the public after the Governor’s budget address. Before the Illinois House of Representatives passed a 1,450-page capital bill by a wide majority on May 30, 2012 and the state Senate unanimously concurred on May 31, 2012, the only information published on the Governor’s budget website regarding the capital budget was a nearly 4000-line spreadsheet of proposed projects to be funded.

The Governor issued a line-item veto when approving the capital bill on June 30, 2012. This action eliminated $11.3 million in new funding intended to establish a revolving loan fund administered by the Illinois Finance Authority that would have been used to make loans for new vehicles and equipment for statewide fire protection districts, township fire departments and non-profit ambulance services.

Currently the only information available about the capital expenditures approved by the State for FY2013 is included in the capital budget bill. The Governor’s Office of Management and Budget also made available a summary spreadsheet of the enacted capital budget by request, which can be viewed here. However it is nearly impossible to track the progress and changes in funding for ongoing infrastructure projects without a detailed budget book.

(The following text is an excerpt from the recently published IIFS analysis of the State of Illinois Enacted Budget FY2013, which can be downloaded here.)

Capital Budget

The FY2013 capital budget marks the fourth year of the State’s $31 billion Illinois Jobs Now! capital program. The capital budget includes reauthorization of $20.7 billion in previously approved projects and $2.0 billion in new appropriations, bringing the total to $22.7 billion. [1]

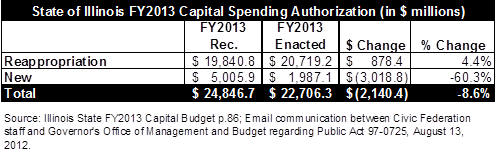

Although the FY2013 capital budget includes a significant increase in capital spending, the enacted total is less than the increase proposed in the Governor’s recommended FY2013 capital budget. The total capital spending approved for FY2013 was $3.0 billion less than the total $24.8 billion in the Governor’s recommendation, which proposed $3.0 billion in new grant programs to fund statewide investments in water systems, school technology and state facilities.

The following table compares the capital budget proposed by the Governor for FY2013 to the enacted capital budget.

The amount of capital spending reauthorized from previous years increased slightly due to some projects spending less of the existing appropriations before the end of FY2012 than was estimated in the Governor’s capital budget. The more significant reduction in the FY2013 capital authorization was the $3.0 billion in new projects proposed by the Governor but omitted from the capital bill approved by the General Assembly.

The new spending in the enacted capital budget is almost entirely dedicated to additional transportation spending on roads, bridges, airports, rail and mass transit. Transportation spending makes up $1.5 billion, or 78%, of the total new spending in the capital budget and consists almost entirely of broad grants given to the Illinois Department of Transportation that are later assigned to specific projects. This includes $400 million in federal funding for high speed rail, $130 million in federal and local funding for airport projects and $299.2 million in local funding for statewide road program.

The largest new State-funded appropriation is a $200 million increase in funding for the State’s wastewater loan program. The largest new State-funded projects specifically included in the enacted FY2013 capital budget are $1.5 million to Sangamon County for maintenance needs at the State Fair Grounds and $1.5 million to the Cook County Health and Hospitals System to pay for medical equipment at Provident Hospital. There are 84 specific projects and grants in the new capital spending that total less than $1.5 million and amount to a total of $33.0 million of the newly enacted projects.

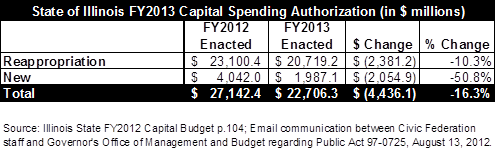

Compared to FY2012, total approved spending in the FY2013 capital budget declines by $4.4 billion. In FY2013 reappropriations decrease by $2.4 billion and new capital spending is down by $2.1 billion. The following table compares the total spending enacted in the FY2013 capital budget to the totals for FY2012.

The State relies heavily on the sale of bonds to fund the capital budget but also receives federal funding and some pay-as-you-go funding from user fees, taxes and local government funds. Updated estimates of the funding for the enacted FY2013 budget are not yet available, but the Governor’s FY2013 proposed budget estimated that $13.6 billion, or 54.9% of total capital spending remaining in capital budget, will be paid for with General Obligation (GO) bonds issued by the State. [2] The State has issued $6.3 billion in bonds to pay for capital projects since the capital program began in FY2010. [3]

The package of new revenue sources authorized in FY2010 to pay for the additional debt-related to spending on Illinois Jobs Now! consists of the following: [4]

- Statewide legalization and taxation of video poker;

- Expanded sales tax on candy, sweetened beverages and some hygiene products;

- Leasing a portion of state lottery operations;

- Increased per gallon tax on beer, wine and liquor; and

- Increased license and vehicle fees.

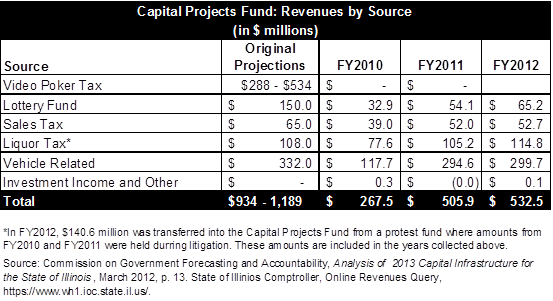

The proceeds from these sources are deposited in the Capital Projects Fund and used to pay for debt service on new capital bonds and some ongoing capital expenses. However, the taxes and fees have yet to produce the funding levels projected when Illinois Jobs Now! was originally approved.

The majority of the shortfall in capital projects funding is due to the delay in implementation of the legalization and taxation of video gaming. The following table compares the original legislative projections for annual revenue from the new taxes and fees to support the capital budget and the actual results for FY2010 through FY2012.

Due to administrative delays, the State Gaming Board only recently began licensing video poker. The first video gaming establishments in Illinois began operations in October 2012 and some revenues from the 30% tax on video gaming proceeds can now be expected in FY2013. There are reportedly 70 establishments with roughly 230 machines operating in so far, however, the estimated revenues from video gaming in the table above are based on 45,000 to 65,000 machines generating daily revenues of $70 to $90 each per day.

More than 60 county and local governments have passed measures to prohibit the expansion of video gaming in their jurisdictions, which also threatens the potential revenues from the capital program’s largest source. This reduction in participating governments is expected to reduce video gaming proceeds to support the capital budget by between $68 million and $124 million. [5]

[1] Public Act 97-0725. Email communication between the Civic Federation and the Governor's Office of Management and Budget, August 13, 2012.

[2] Illinois State FY2013 Capital Budget, p. 86.

[3] Commission on Government Forecasting and Accountability, State of Illinois Budget Summary Fiscal Year 2013, August 2012, p. 181.

[4] Public Act 96-0034, 96-0037, 96-0038.

[5] Commission on Government Forecasting and Accountability, Analysis of 2013 Capital Infrastructure for the State of Illinois, March 2012, p. 13.