December 04, 2014

The Illinois House adjourned on Wednesday, December 3, 2014 with no further session days scheduled before the 99th General Assembly begins in January 2015. The Illinois Senate is expected to adjourn on December 4, 2014 and has one addition session day scheduled for January 13, 2015. This will mark the end of the 98th General Assembly.

At the end of each two-year legislative session, all of the bills not passed by both chambers of the General Assembly are cleared from the legislative agenda and can no longer be considered. Any previous legislation must be filed under new bill numbers and the deliberative process must begin again.

As previously discussed in this blog, the FY2015 budget passed by the 98th General Assembly leaves several critical budget issues unresolved including a looming revenue drop when the temporary income tax increase expires on January 1, 2015 and a backlog of unpaid bills that is projected to total approximately $6.4 billion at the end of FY2015. Serious financial issues also remain including the uncertainty surrounding the State’s pension reform law; the severely underfunded Chicago, suburban and downstate pension funds that will require adjustments to State-mandated funding requirements and benefit levels; and the State’s historically low credit rating that is the lowest of all 50 states in the union.

Without a special session, the next opportunity for legislators to address these issues will be after the 99th Illinois General Assembly is sworn in on Wednesday, January 14, 2015. Constitutional officers, including the Governor, will be sworn in on Monday, January 12. According to Illinois statute, the General Assembly’s annual budget deliberations generally fall between the Governor’s budget address in February and the final day of scheduled regular session on May 31.

Governor-elect Bruce Rauner is scheduled to present his FY2016 budget proposal to the 99th General Assembly on Wednesday, February 18, 2015. Since the FY2012 budget, the Governor has been required to present a budget based only on existing revenue sources. The Illinois Constitution and State law also require that the Governor’s proposed budget and the legislature’s enacted budget be balanced. However, the legislative requirement is less restrictive than the requirement that applies to the Governor. While the Governor is required to propose expenditures that do not exceed available resources, the General Assembly is only required to maintain a balance between resources and appropriations. This excludes any transfers out that are included with appropriations in total General Funds expenditures.

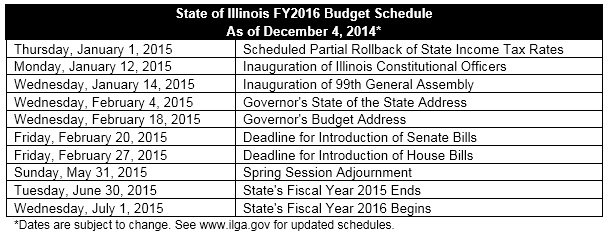

The following table summarizes key dates for the State’s FY2016 budget negotiations as of December 4, 2014.

These dates are subject to change. Although State law requires the Governor to issue his annual budget recommendation by the third Wednesday in February, the General Assembly has approved five delays in the last six years. Budget-related legislation is also frequently considered during the fall veto session or during special sessions throughout the year.

The Illinois General Assembly’s website, www.ilga.gov, includes updated information on session and committee schedules for the Illinois House and Senate and the full text of enacted and introduced legislation as well as video and audio feeds for live session and committee hearings. Follow the IIFS blog and reports for full analysis on the FY2016 budget process.