October 18, 2013

According to the latest legislative report on gaming in Illinois, total casino revenues have recovered since the opening of the State’s tenth riverboat casino in 2012 after several years of decline. However, State tax revenues from casino gaming remain stagnant despite the improvement.

The annual report from the Commission on Government Forecasting and Accountability (COGFA) on wagering revenues and the corresponding taxes generated in Illinois was published earlier this month and includes extensive analysis of the lottery, casino gaming, video gaming and horseracing in the State.

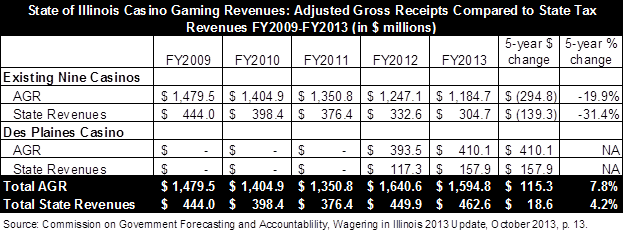

COGFA’s research shows that the new Des Plaines casino brought in $393.5 million in adjusted gross receipts in FY2012 and $410.1 million in FY2013, which is double the total of any other casino in the State. However, due to a downward trend in revenues at the other nine locations, gross receipts from Illinois casinos have only increased by $115.3 million over the last five years and State taxes on casino gambling have only netted an $18.6 million increase over the same period.

The following chart shows the revenue and State taxes generated by the nine existing casinos in Illinois since FY2009 compared to the new location in Des Plaines.

The table above shows the total State tax revenue generated by the graduated rates charged against the total adjusted gross receipts earned by casinos. The State charges a tax rate of between 15.0% and 50.0% depending on total income beginning at $25 million for the lowest rate and over $200 million for the highest. However, not all of the funds generated are available to the State to support its General Funds operating expenses. The expansion of the Des Plaines casino included provisions that distributed State tax revenue to other purposes including the Horse Racing Equity Fund, Cook County Criminal Justice System and Chicago State University. These diversions totaled $74.8 million in FY2012 and $77.9 million in FY2013, reducing annual State revenues to $375.1 million and $384.7 million, respectively.

The report from COGFA shows that although the addition of the Des Plaines casino increased total gaming industry revenues by 18.1% from FY2011 levels, the State’s tax revenues available for operations increased by only 2.2%. In FY2013 State casino tax revenues remain lower than FY2009 levels. This disparity is explained as a result of the transfers for other purposes discussed above and attributed to “cannibalization” of the graduated tax structure. Some of the revenues earned at the Des Plaines location reduce the revenues to other casinos and also push the other locations down into a lower tax rate, leading to lower State revenues despite overall increases in total gaming receipts.

On a positive note, COGFA’s analysis includes the conclusion that the Des Plaines casino helped bring some gaming dollars into the State that had previously been spent in Hammond, Indiana. The casino in Hammond saw a reduction of $102.8 million in FY2013, a large share of which is thought to be attributable to the new Illinois location.

When the Illinois General Assembly reconvenes next week there is likely to be another push to pass further gaming expansion in Illinois. The wagering report from COGFA includes an analysis of the gaming expansion included in Senate Bill 1739, which already passed the Senate in May 2013 but was not taken up in the House. The bill would add five new casinos including one in Chicago, increase the number of gaming positions at the existing casinos and add slot machines at the horseracing tracks in Illinois. The measure is similar to the expansion passed in 2012 by the General Assembly, SB1849, which was vetoed by Governor Pat Quinn in August 2012.

The Commission estimates that although the expansion included in SB1739 would lead to an increase in casino gaming revenues of 110%, State tax revenues will only increase by 43.0%. The report points out that the proposed expansion includes a reduced tax structure and would likely further reduce tax revenues from other casinos leading to limited gains for the State. Not included in these estimates are the one-time revenues collected for the sale of the new licenses and charged for the increased gaming positions at existing locations and racetracks, which could bring in more than $1.0 billion.