June 05, 2014

A week after the Illinois General Assembly ended its spring session, legislative leaders circulated new information about the FY2015 spending plan approved by lawmakers.

General Funds spending in the legislature’s budget totals $35.8 billion, according to a budget overview issued by Senator Heather Steans, who chairs one of Senate’s two appropriations committees. That total is $400 million higher than the FY2015 revenue projection of $35.4 billion adopted by the General Assembly and discussed here.

The difference apparently relates to statutorily required diversions from General Funds beginning on February 1, 2015 to two new accounts to support education and human services. The $35.8 billion total includes the diversions of approximately $400 million as part of General Funds revenues and spending, even though the resources are technically deposited into the Fund for the Advancement of Education and the Commitment to Human Services Fund.

As discussed here, the budget approved by the General Assembly in the last days of the session that ended on May 31, 2014 does not cut spending or extend existing income tax rates that are scheduled to be rolled back midway through FY2015. It relies instead on short-term measures, including borrowing and shifting revenue from FY2014, to cover operating expenses in FY2015.

In developing the last three State spending plans, the General Assembly has begun by allocating General Funds resources to what have been called non-discretionary spending areas—expenditure categories that have been viewed as relatively difficult to reduce due to law, contract or court order. These include pension contributions, debt service, group insurance, legislatively required transfers and Medicaid spending. Remaining resources are then allocated to discretionary appropriations, which include most agency spending.

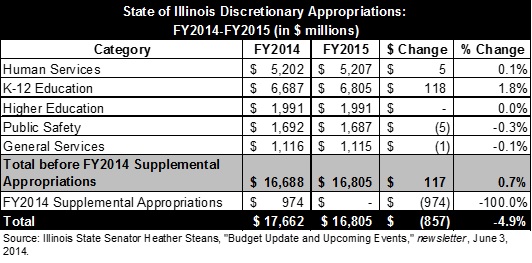

The table below compares discretionary appropriations in FY2014 and FY2015, based on Senator Steans’ data.

Excluding FY2014 supplemental appropriations, discretionary spending authorization for the two years is relatively flat. The main exception is elementary and secondary education, which increases by $118 million, or 1.8%, to $6.8 billion from $6.7 billion. Lawmakers have said the increase was intended to provide enough General State Aid to fund 89% of the Foundation Level, roughly the same percentage as in FY2014. The Foundation Level, which is established by statute, represents the minimum per child amount of financial support that should be available to provide for the basic education of each student. General State Aid, the largest State funding source for school districts, is designed to help fill the gap between the Foundation Level and the amount a district can provide from local property tax revenues and other local resources.

The categories of elementary and secondary education and human services each include $200 million from the new funds. The $200 million for education will be used for General State Aid.

Of the $200 million for human services, $99 million will be used for the Department on Aging’s Community Care Program, which is designed to help senior citizens stay in their own homes. The remaining $101 million will go to programs for the developmentally disabled at the Department of Human Services.

The FY2014 supplemental appropriations approved by the General Assembly total $974 million in General Funds, according to Senator Steans. Of the total, $600 million is appropriated to the Department of Healthcare and Family Services for Medicaid spending in FY2015. Another $100 million will be used to pay for group health insurance costs in FY2014, which were higher than initially projected. The legislature approved the use of $50 million in FY2014 to pay approximately 45% of the $112 million in back wages owed to union employees due to a dispute over cancelled raises. The supplemental appropriations are funded by a projected operating surplus in FY2014 caused by higher than projected income tax revenues.

Beginning on January 1, 2015, income tax rate increases enacted in 2011 are scheduled to be phased out, resulting in an estimated reduction of $1.7 billion in income tax revenues in FY2015 from FY2014. Individual income tax rates, increased to 5.0% from 3.0%, roll back to 3.75%; corporate income tax rates, increased to 7.0% from 4.8% (not including a 2.5% Personal Property Replacement Tax), roll back to 5.25%. The full-year impact of the lower tax rates will not be felt until FY2016.