April 26, 2012

A key component of Governor Pat Quinn’s proposal to close the State of Illinois’ $2.7 billion Medicaid funding gap in FY2013 is an increase in the State’s cigarette tax.

The Governor projects that a $1 a pack increase in the cigarette tax, to $1.98, would bring $337.5 million in new revenues to the State to pay for Medicaid expenses. Medicaid spending is reimbursed by the federal government at a rate of 50%. The Governor expects federal reimbursements to bring in another $337.5 million, resulting in total Medicaid funding of $675 million due to the tax increase.

How does this math work? The tax revenue is doubled through a cycle of State Medicaid spending and federal reimbursement known in Illinois as “churning.”

For simplicity, imagine that all of the revenue from the tax increase is collected at one time and that all of the federal reimbursements are used directly to pay Medicaid bills. The cycle starts when the State spends $337.5 million on Medicaid bills and receives a 50% reimbursement from the federal government, or $168.75 million.

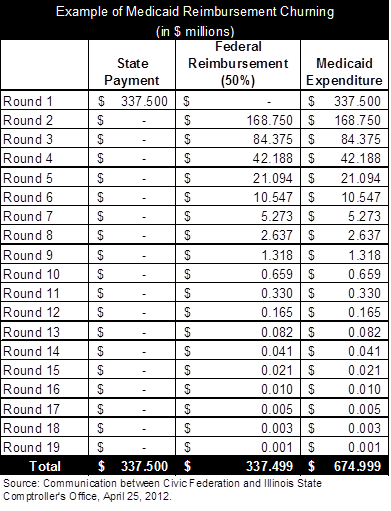

The State then spends the $168.75 million on Medicaid and receives another 50% reimbursement, or $84.375 million, and so on. As shown in the table below, this process can be repeated 19 times until Medicaid spending totals almost $675 million: approximately half from the cigarette tax and half from federal reimbursements.

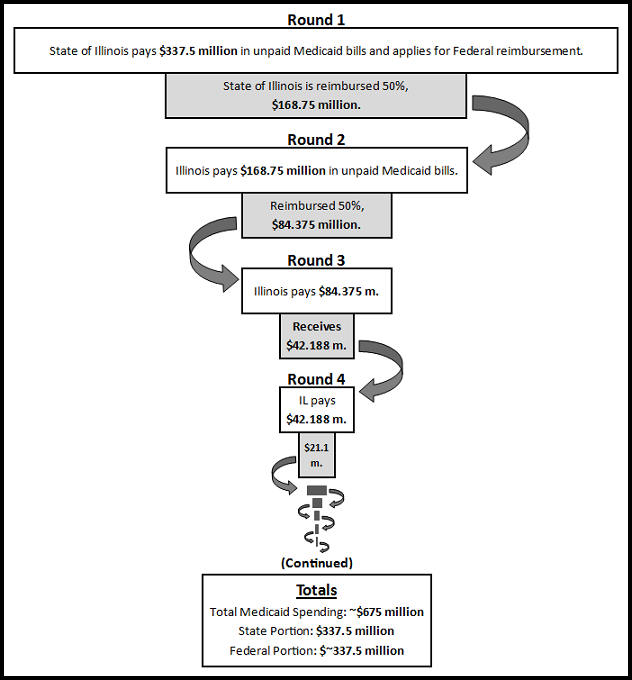

The cyclical aspect of churning can be seen best through a diagram. The diagram below illustrates how State spending leads to federal reimbursement, resulting in additional state spending and so forth.

In actuality, tax revenues would be collected over time. How quickly federal reimbursements could be spent on Medicaid bills, drawing more federal funds, depends on whether the new cigarette tax revenues are deposited into the State’s general operating funds or into a special fund used to pay Medicaid bills.

If the additional tax revenue goes into general operating funds, then federal reimbursements might be spent on higher priority bills, delaying additional Medicaid spending and the resulting federal reimbursement. Depositing the additional tax revenue in a special Medicaid fund could mean that the reimbursements will be used more quickly for Medicaid.

It is not yet clear how the cigarette tax money would be allocated under the Governor’s plan. The cigarette tax increase is only one component of the $2.7 billion plan, which also includes Medicaid program reductions of $1.38 billion and reimbursement rate reductions to healthcare providers (excluding doctors) of $675 million.

As discussed here, Governor Quinn in his FY2013 budget speech on February 22, 2012 said that $2.7 billion in Medicaid program costs must be cut to avoid a $4.5 billion backlog of bills by the end of the year.