June 19, 2014

Under Illinois law, the State is required to share a certain portion of state income tax receipts with municipal and county governments in Illinois through the Local Government Distributive Fund (LGDF). The state revenue shared with local governments is a legislatively required transfer from the General Fund to the Local Government Distributive Fund. The Illinois Comptroller then distributes the funds to the local governments based on population. Local governments are able to broadly use this revenue source for general operating costs without restrictions. The Civic Federation’s Institute for Illinois’ Fiscal Sustainability has previously written about legislatively required transfers in this blog.

The State’s own budgetary issues have put a major strain on local government budgets across Illinois. Prior to the 2011 state income tax increase local governments received a 10.0% share of the income tax revenue. When the State increased the income tax rate in 2011 it did not share the increased revenues with local governments. Rather than receiving the 10% share of the newly increased income tax rates, local governments only received 6% of the increased individual income tax revenue and 6.86% of the corporate income tax increase. This preserved the 10.0% ratio of funding for the original 3.0% of the individual income tax rate and 4.8% of the corporate income tax, but excluded the local governments from receiving additional funding when the rates increased to 5.0% and 7.0% in January 2011.

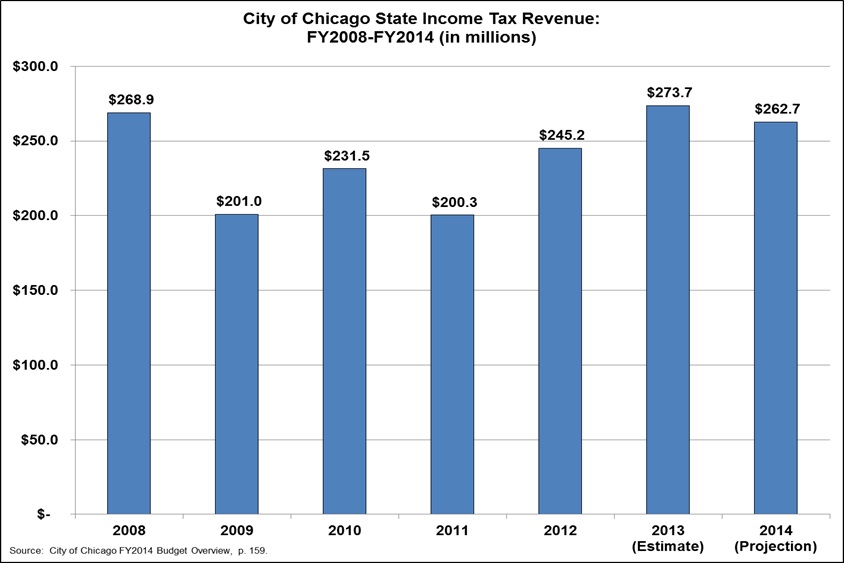

To highlight the budgetary impact of local income tax receipts on local governments, the following graph displays seven-year trend data for the City of Chicago’s income tax revenue. State income tax revenue distributed to the City has ranged from a high of $268.9 million in FY2008 to a low of $200.3 million in FY2011. In FY2013, the City of Chicago is estimated to receive $273.7 million. Over the seven-year period the average annual income tax revenue is estimated at $240.5 million.

In FY2009, due to the economic downturn, income tax revenue fell by $67.9 million or 25.3% to $201.0 million, from the previous year followed by an increase of $30.5 million, or 15.2%, in FY2010. As a result of a delay in state payments, a reduction in population following the release of 2010 Census numbers, the poor health of the State’s economy and the ‘depreciation bonus rule’[1], the City of Chicago’s portion of income tax revenue decreased to $200.3 million in 2011.[2] In 2012 the income tax revenue that the City of Chicago received increased by $44.9 million, or 22.4% to $245.2 million due to an improved economy and the State catching up on income tax payments to local governments. Between FY2008 and FY2012, the actual income tax revenue received by the City of Chicago fell by $23.7 million, or 8.8%. In FY2013 the income tax revenue that the City of Chicago receives is estimated to increase by 11.6%, or $28.5 million, followed by a projected decrease in FY2014 by 4.0% to $262.7 million.

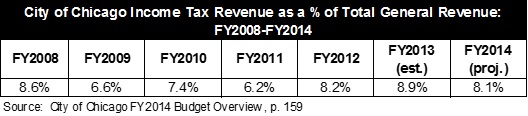

The following chart displays the City of Chicago income tax revenue as a percentage of general fund revenue. Between FY2008 and FY2012, the income tax revenue distributed to the City of Chicago has ranged from a high of 8.6% in FY2008 to a low of 6.2% in FY2011. It is estimated that in FY2013 income tax revenue will make up 8.9% of general fund revenue. While in FY2014 the City of Chicago is projecting a slight decrease to 8.1% from its FY2013 estimate.

Aside from local governments not being included in the income tax increase, in recent years the State has delayed distribution of the local share of income taxes to local governments between two and six months. This has caused serious budgetary problems for local governments that have come to rely on the income tax as an important revenue source for balancing their budgets. For example, in 2010 and 2011, the State delayed payments to the City of Chicago for an average of 120 days.[3]

House Bill 0961, which was recently passed by the Illinois General Assembly and is awaiting the Governor’s signature, would require the State to transfer income tax revenue to the Local Government Distributive Fund within 60 days. This legislation will help to ensure that municipalities and counties receive their share of the income tax in a timely manner and would allow for the local share of the income tax to be a more predictable source of revenue throughout the budget year.

[1] The federal depreciation bonus rule was adopted as part of the Tax Relief, Unemployment Insurance Reauthorization and Job Creation Act of 2010 and significantly reduced the corporate tax base.

[2] City of Chicago, 2012 Annual Financial Analysis, p. 13 and 14.

[3] City of Chicago, 2012 Annual Financial Analysis, p. 14.