January 10, 2014

Despite savings from recently enacted pension reforms, the State of Illinois’ finances could still worsen considerably after income tax increases are partially phased out as scheduled beginning in 2015, according to a report by Governor Pat Quinn’s office.

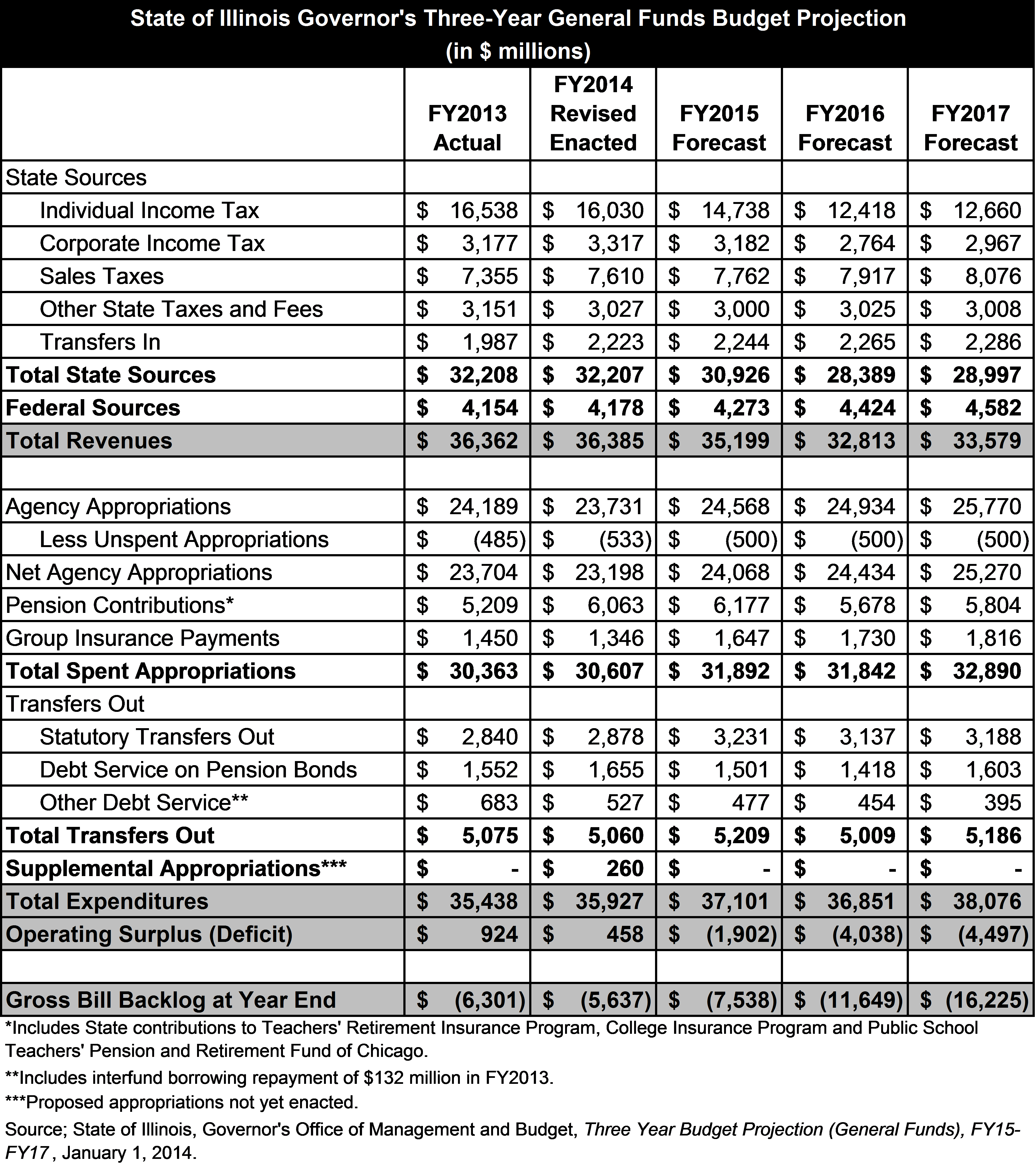

The three-year general operating budget projection by the Governor’s Office of Management and Budget (GOMB) and an accompanying economic and fiscal policy report show the State’s operating deficit increasing from $1.9 billion in FY2015 to $4.6 billion in FY2017. During the same period, the backlog of unpaid bills is projected to grow to $16.2 billion from $7.5 billion.

Budget deficits and unpaid bills mount because the projection assumes that income tax revenues decline while expenditures increase to maintain State services at current levels. Due to the partial sunset of temporary income tax increases enacted in FY2011, income tax revenues are expected to drop by $1.4 billion in FY2015 and an additional $2.7 billion in FY2016.

The report also suggests that savings from the pension law enacted on December 5, 2013 might be significantly below previous projections. Supporters had estimated that the plan would reduce State contributions in FY2016 by about $1.2 billion. The new projection shows FY2016 savings of approximately $673 million on General Funds contributions. With General Funds contributions representing about 89% of total State pension contributions, the projection indicates total savings of about $756 million.

The pension savings numbers are subject to revision because the Teachers’ Retirement System (TRS), the State’s largest pension fund, has not provided contribution estimates based on the final version of the new law, according to GOMB officials. As previously discussed on this blog, the pension reform effort was focused on stabilizing the State’s long-term pension costs and establishing an actuarially sound funding plan rather than achieving immediate savings.

The table below summarizes GOMB’s projection for the General Funds budget from FY2015 to FY2017. The three-year projection also includes updated results for FY2013 and FY2014.

Illinois temporarily raised income tax rates in January 2011 from 3% to 5% for individual taxpayers and from 4.8% to 7.0% for corporations (9.5% including the Personal Property Replacement Tax or PPRT). On January 1, 2015, individual income tax rates are scheduled to roll back to 3.75% and corporate tax rates are scheduled to decline to 5.25% (not including the PPRT). Since the State budget year begins on July 1, the first full-year impact of the partial rollbacks will be in FY2016.

The Governor’s report projects that total General Funds revenues will decline by $1.2 billion in FY2015 to $35.2 billion from $36.4 billion in FY2014. In FY2016 total revenues decline by an additional $2.4 billion to $32.8 billion. This would be an aggregate decline of $3.6 billion from FY2014 and the lowest General Funds revenue total since FY2010, the last year prior to the income tax increase when General Funds revenues totaled $30.2 billion.

Personal income taxes decline by $1.3 billion in FY2015 and $2.3 billion in FY2016, while corporate income taxes decline by $135 million and $418 million in the same years. These losses are slightly offset by increases in sales tax revenues of $152 million in FY2015 and $155 million in FY2016. Federal revenues are also expected to increase by $95 million and $151 million in the same years.

General Funds revenues increase by $766 million to $33.6 billion in FY2017 due to natural growth but still remain below the FY2011 level of $33.8 billion.

The projection assumes that General Funds net agency spending (not including pension contributions and group insurance and taking into account unspent appropriations) will increase by 3.8% to $24.1 billion in FY2015 from an estimated $23.2 billion in FY2014. Net agency spending is projected to grow to $24.4 billion in FY2016 and $25.3 billion in FY2017, or about 2.5% a year. These increases reflect the cost of maintaining State services at the same level as in FY2014, according to GOMB.

The spending increases in the new projection are in contrast to GOMB’s three-year projection last year. In the previous projection, covering FY2014 to FY2016, the administration showed the significant spending reductions needed to balance the budget in FY2015 and FY2016, when temporary income tax rate increases start to be phased out.

The deficits and unpaid bill backlogs in the new projection triggered a range of responses. Voices for Illinois Children, an advocacy group, said the anticipated budget problems show a need to extend the tax increases. Illinois Senate Republicans said the State should reduce spending in order to allow the tax increases to be phased out.

The projection shows estimated State pension contributions required in FY2016 and FY2017 under the new pension reform law. Although the law takes effect on June 1, 2014, its implementation is expected to be delayed by legal challenges; the State’s five retirement systems have already certified FY2015 contribution amounts required under existing pension law, which took effect in 1995.

Two of the retirement systems, the State Employees’ Retirement System (SERS) and the State Universities Retirement System (SURS), provided new estimates of State contributions in FY2016 and FY2017 based on the provisions of the law enacted in December. The new estimates show savings in FY2016 of $81.2 million for SERS and $145.9 million for SURS compared with projected contributions under the 1995 law, according to GOMB.

The TRS contributions in the projection are based on a preliminary version of the new pension law and indicate savings of $446 million in FY2016. The smallest system, the General Assembly Retirement System, did not provide contributions under the new law and the Judges’ Retirement System is not affected by the legislation.

The reduction in expected savings under the new law is partly related to the base numbers used in the initial calculation. Supporters of the new law based savings estimates on projected contributions determined by actuarial valuations as of June 30, 2012, while savings estimates by GOMB are based on more recent actuarial valuations as of June 30, 2013.

As previously discussed on this blog, the retirement systems experienced strong investment results in FY2013. As a result, system actuaries in 2013 generally lowered their projections of State contributions required in future years. The 2012 valuations projected total required State contributions of $7.237 billion in FY2016, while the 2013 valuations projected total required contributions of $6.983 billion.

The impact of the new pension law is also being reviewed by actuaries for the legislature’s Commission on Government Forecasting and Accountability.

More details about Governor Quinn’s budget plans for FY2015 will be available when he issues his recommended budget. The State Budget Law requires the Governor to deliver a budget address for the next fiscal year by the third Wednesday in February, unless otherwise directed by law. Last year’s budget address was postponed from February 20, 2013 to March 6.