January 06, 2012

Governor Pat Quinn released a three-year budget projection for the State of Illinois this week that shows only minor improvements in the State’s financial circumstances in the near term and declining prospects for Illinois’ future fiscal stability.

The budget plan, required by law to be issued the first week of January, provides an update to the FY2012 State budget after changes made during the General Assembly’s veto session and gives revenue and spending projections for the next three fiscal years. This is only the second year that the Governor has been required to release these projections in advance of his annual budget recommendation, scheduled for February 22, 2012.

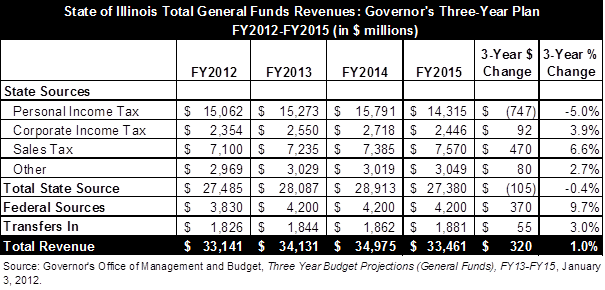

The updated FY2012 General Funds revenue estimate of $33.1 billion provided in the document is slightly lower than the revenue estimate of $33.2 billion enacted by the General Assembly last spring. This decline is largely attributable to much lower expectations for federal revenues, which fell by 20.9% from $4.8 billion in the original enacted FY2012 projections to $3.8 billion in the latest projections. The decline in federal revenues is due to reduced appropriations for the State’s Medicaid program in the revised FY2012 budget, which reduces federal matching dollars received by the State. The loss of federal revenues is mostly offset by projected increases in other State revenues, including growth of $107 million in personal income taxes, $345 million in corporate income taxes and $514 million in sales taxes.

The new projections for General Funds revenues show moderate annual growth in FY2013 and FY2014. In FY2015, when the State’s income tax increase is scheduled to partially sunset halfway through the fiscal year, General Funds revenues are expected to decline to nearly FY2012 levels. The following chart shows the new General Funds revenue projections for FY2012 through FY2015.

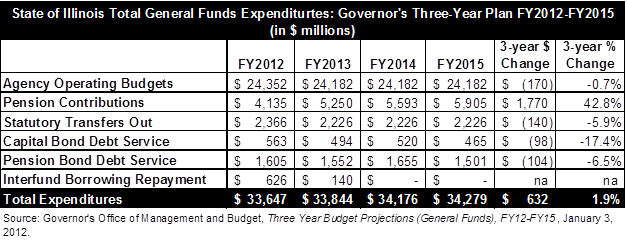

According to the economic and fiscal policy report that accompanied the three-year forcasts, the lack of significant revenue growth and the increase in the State’s pension-related costs will continue to put a strain on the State’s annual operating budgets. To cope with the pressure, the Governor plans to cut State agency operating budgets in FY2013 and hold them flat through FY2015. The State’s annual pension contributions are expected to grow by $1.8 billion between FY2012 and FY2015, from $4.1 billion to $5.9 billion. Total agency operations are to be reduced by $170 million, statutory transfers out decrease by $140 million and the state’s debt service owed for capital and pension bonds also declines slightly. Within the State agency budgets, the Governor’s three-year plan avoids cutting the operating budgets for education and Medicaid related programs in FY2013. Instead these catagories are held flat at FY2012 levels through FY2015, which total $8.9 billion annually for education and $6.6 billion annually for Medicaid.

The following table shows the three-year General Funds expenditures projections for FY2012 throgh FY2015.

As shown in the table above, increases in pension contributions outpace declines in all other categories of spending. The projections do not account for the full annual cost of the Medicaid program and appear to assume that significant cuts in Medicaid spending will be enacted. The Governor’s accompanying report notes that anticipated Medicaid costs were underfunded in the FY2012 budget by roughly $2 billion, although this number was reduced somewhat by additional General Funds transfers out approved during the veto session (Public Act 97-0461). The Medicaid costs that were not funded in FY2012 will be carried over into FY2013 as unpaid bills. Despite the inadequate funding in FY2012, the Governor’s projections show Medicaid appropriations remaining flat from FY2012 through FY2015. The projections also do not reflect annual increases in the cost of providing healthcare services. Medicaid reform legislation (Public Act 96-1501) enacted in January 2011 is not expected to generate significant savings for several years.

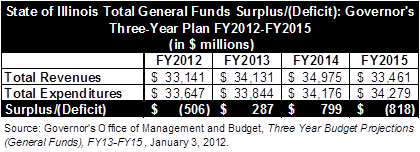

Including unpaid Medicaid bills, the State is expected to have a backlog of unpaid bills of approximately $8 billion by the end of FY2012. The three-year budget projections do not provide funding to significantly reduce these obligations. As shown in the table below, the budget projections only generate moderate surpluses in FY2013 and FY2014 before the income tax increases partially sunset in FY2015. After the taking into account the decline in revenues associated with the personal income tax rate reduction from 5.0% to 3.75% and the corporate income tax rate from 7.0% to 5.25% on January 1, 2015, the State will face a significant operating deficit, totaling $818 million.

The table below compares expenditures to revenues and shows the deficits and surpluses for FY2012 to FY2015 included in the Governor’s three-year projections.

The projected General Funds surpluses shown above are not enough to significantly pay down the State’s outstanding liabilities. Rather than use General Funds resources to pay down the State’s backlog of bills, the economic and fiscal policy document suggests borrowing $7.0 billion to pay down these liabilities. The Governor proposes using debt proceeds to repay $3.5 billion in unpaid bills held by the Comptroller, $2 billion in unpaid Medicaid bills, $500 million for tax refunds owed to businesses and $1 billion in unpaid State Group Health Insurance bills. However, the terms of the borrowing, such as the repayment schedule and total estimated debt service costs, are not included in the report. It also does not appear that the State could afford additional debt service cost after FY2015 when the revenues are expected to drop from the scheduled partial sunset of the increased income tax rates. The State should expect an additional drop in revenues in FY2016, when the lower income tax rates from the partial sunset are in effect for the entire year.

Last year as part of the FY2012 budget proposal, the Governor recommended a similar borrowing plan, calling for the sale of $8.75 billion in General Obligation Restructuring Bonds (GORB) to be repaid over 15 years. It was estimated that the interest costs associated with the debt repayment would total approximately $4.0 billion. The proposed borrowing plan did not gain support in the General Assembly and was not included in the FY2012 enacted budget.

As mentioned in both the Governor’s three-year projections and the economic and fiscal policy report, these initial projections for expenditures and revenues are meant to be a preview of the challenges facing the State for the FY2013 budget and are expected to change prior to the release of the Governor’s formal budget proposal.