July 19, 2012

As stated in its analysis released today, the Civic Federation opposes the Chicago Public Schools (CPS) proposed $5.2 billion operating budget for FY2013, which drains all General Fund reserves to help close a $665 million budget deficit and leaves the District with no identifiable plan to address a devastating financial reality. The Federation urges the Chicago Board of Education to reject the proposed budget in favor of a financially responsible plan that accounts for current and growing future liabilities.

CPS proposes to completely drawdown its unrestricted fund balance to use a total of $432 million in reserves: $349 million will be drawn from the District’s unrestricted fund balance and $25 million will come from restricted reserve funds. An additional $57.8 million of state discretionary funding not spent in FY2012 will also be used to close the budget gap.

Not only is this proposal an irresponsible stopgap to a larger ongoing structural deficit, but by completely drawing down its unrestricted reserves, CPS fails to follow its own fund balance policy which states its fund balance “should carry a minimum 5 percent of the operating and debt-service total budget in the following year’s budget.” The budget does not provide concrete details regarding CPS’ intentions to replenish its fund balance. The Federation strongly opposes the District’s proposal to break its own fund balance policy and put off replenishing its fund balance by at least another two years.

In addition to drawing down its fund balance, CPS plans to continue its reliance on one-time revenue sources by appropriating expected TIF funds of $30.0 million to the closure of its budget deficit – an increase of $14.0 million from FY2012 year-end estimates. It is not of sound fiscal practice to consistently use a one-time revenue sources in lieu of recurring revenues. Such repeated use is a strong indicator of a structural deficit that must be addressed because reserves will eventually be depleted, as in the current predicament with CPS.

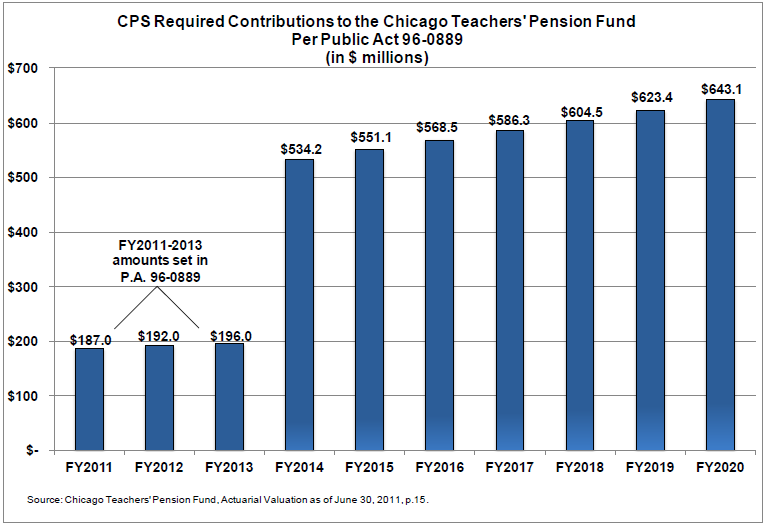

Draining the General Fund reserves is particularly alarming because of the $338.2 million pension contribution increase the District will see in FY2014, following the end of a three-year partial pension contribution holiday. In FY2014 the District’s pension contributions will increase significantly, from $196.0 million in FY2013 to $534.2 million, as shown in the chart below. The impact of this increase will be further intensified because the District will have no fund balance available to help close its deficit. The Chicago Teachers’ Pension Fund has fallen from 100 percent funded in FY2000 to 61.1 percent funded in FY2011 on a market value of assets basis. The decline is due in part to the State’s elimination of its regular contribution to the pension fund and the three-year reduction in required CPS employer pension contribution established by P.A. 96-0889.

It is readily apparent the District may no longer be able to afford its existing pension system. The Federation is urging the Chicago Public Schools Board and administrative leadership to develop and present a pension reform plan to the Illinois General Assembly that ensures a greater balance of employee, retiree and taxpayer interests.

The analysis finds that CPS’ long-term debt increased by 28.3%, or $1.1 billion, between FY2007 and FY2012. The District is already projecting a $1.0 billion deficit for FY2014 due to its ongoing structural deficit and the end of the three-year partial pension contribution holiday. Moody’s Investors Service downgraded the District’s credit rating on July 10, citing an above-average debt burden, substantial reduction in reserves and increased pension obligations. The downgrade is likely to be just the first of many negative consequences CPS will experience if it fails to immediately address the key drivers of its financial crisis with significant structural changes.

The Federation offers support for several elements of the proposed budget that should be incorporated by the Board of Education as part of a more realistic financial plan. These include the production of a prioritized, publicly-available capital improvement plan, the implementation of $144.3 million in expenditure reductions and a painful but necessary increase in the District’s property tax levy by the maximum amount allowed by the tax cap law, generating $62.0 million in much-needed additional revenue. The Federation also urges the District to institute a formal, publicly-available financial planning process to address its structural deficit, soon-to-be-depleted fund balance and looming pension crisis.