February 05, 2014

This week the Chicago City Council granted the City authority to issue $900.0 million in general obligation bonds and $1.0 billion in Midway Airport revenue bonds. At the Finance Committee meeting on February 3, 2014, the City’s Chief Financial Officer Lois Scott said that approximately $90.0-$100.0 million of the GO bonds would be used to pay for litigation settlements from last year. About $130.0 million would be used to restructure debt by delaying principal payments for ten years, a maneuver that would provide budgetary relief in the short-term but would compound costs for taxpayers in the long-term. Approximately $180.0-$200.0 million would be used to refinance existing debt by taking advantage of low interest rates. The new borrowing would additionally fund capital projects related to building safety and Aldermanic Menu items, which are the annual list of ward-based repairs and updates allotted to each council member.

As recently as last fall, the Civic Federation expressed its strong concerns with the City’s debt management strategies, particularly borrowing for operating costs, including tort settlements that should be paid with budgetary reserves, and the deleterious practice of back-loading bonds by pushing off current debt payments into the future, also known as “scoop and toss.”

The Civic Federation recommended that the City revise its debt management policy to require the City to structure its bonds so that equal amounts of the funds borrowed are repaid in each year of the loan. This structure, called level principal, benefits the government’s long-term debt profile by reducing the overall cost of borrowing and protects future borrowing capacity by ensuring annual debt service payments will decline over the life of the bonds.

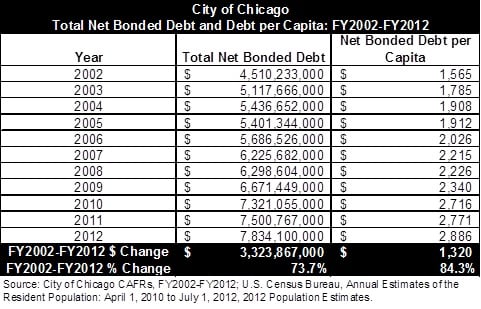

The following chart shows the City’s bonded debt (net of self-supporting debt) and per capita figures from FY2002 to FY2012, the most recent years for which data is available. It is important to note that this data is exclusively general obligation debt issued by the City of Chicago and does not include overlapping debt of the Board of Education, Park District, Cook County and other governments to which Chicago residents pay property tax.

Over the past ten years, the City’s net bonded debt has grown from $4.5 billion in FY2002 to $7.8 billion in FY2012, an increase of 73.7% or $3.3 billion. Net bonded debt per capita has grown from $1,565 per resident to $2,886, an increase of $1,320 or 84.3%.

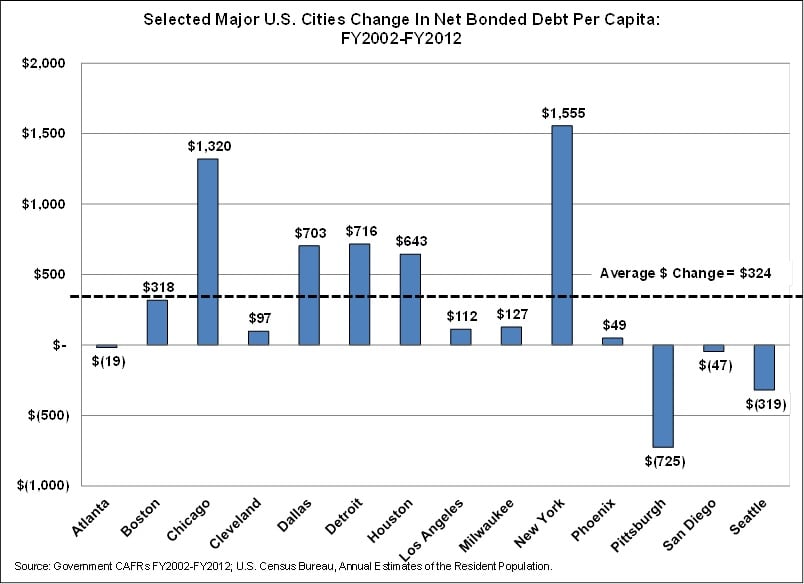

When comparing Chicago to thirteen other large U.S. cities, Chicago’s $2,886 per resident bonded debt burden is the second highest rate. Only New York City’s net bonded debt per capita was higher at $5,072 in FY2012. Additionally, Chicago’s growth in bonded debt per capita over the ten-year period was the second highest, again only after New York. The following graph shows the change in bonded debt per capita between FY2002 and FY2012 for Chicago and other selected U.S. cities.[1] Although most cities saw an increase in the bonded debt burden, Chicago and New York are clear outliers with significant growth over the ten-year period.

[1] It is important to note that due to the differences in government operations among the various cities and how each city reports net bonded debt figures, the total net bonded debt data provided in the chart below are not strictly comparable across cities.