February 19, 2015

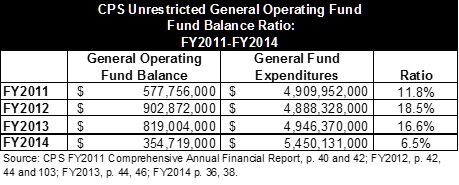

The Chicago Public Schools audited financial statements for fiscal year 2014 released last week indicate the deterioration of the District’s fiscal condition continued through the end of FY2014. The District’s most recent Comprehensive Annual Financial Report (CAFR) reports ending FY2014 with an operating funds deficit of $513 million, which it closed using fund balance. This deficit was smaller than the $642 million budget gap that was anticipated when the District released its FY2015 budget, but over four times the size of the FY2013 year-end deficit of $120 million. Additionally, fund balance levels declined for the second year in a row, falling from 18.5% in FY2012 to 6.5% in FY2014.

This blog discusses two central elements of the District’s FY2014 finances: the timing of second installment property tax bills and the District’s ratio of operating fund balance to operating expenditures.

Revenue Recognition Period

A controversial aspect of the FY2015 CPS budget is not reflected in the FY2014 audited financial statements. In 2014—for the third consecutive year—second installment Cook County property tax bills were sent out on time. Over the previous thirty years, second installment bills had generally been due several months later than the statutory deadline of August 1st. Accounting rules state that the District must include revenues received within 30 days of the end of the fiscal year (June 30th) as revenue for that fiscal year. This means that property tax revenue received July 1-July 30 in 2014 must be counted as FY2014 revenue rather than FY2015 revenue even though it was received after the start of the 2015 fiscal year. Up until July 1, 2012, the 30-day revenue recognition period had little effect on the District’s finances because little to no property tax revenue was received in July.

However, in 2012 Cook County, sent the second installment tax year 2011 property tax bills out on time for the first time in over 30 years, with a due date of August 1, 2012. This means that year and each subsequent year the District has received a large amount of revenue during the revenue recognition period.

As long as Cook County property tax bills are sent out on time, CPS will now collect hundreds of millions of dollars in revenue during the summer and started to budget based on that fact in FY2014. The District made another change based on the assumption that on-time property tax bills will continue. The District made the decision to extend its revenue recognition period from 30 days to 60 days to be able to access revenues collected in that period in the prior fiscal year. This change, however, is not reflected in the FY2014 CAFR. The change to the revenue recognition period is for FY2015 will be reflected in a restatement of FY2014 finances in the FY2015 CAFR.

Audited Fund Balance

A complete ten-year trend analysis of the District’s fund balance ratio including the most recent FY2014 numbers is not possible because data for FY2011 and beyond has been classified differently. Data after FY2011 reflect the implementation of GASB 54, which changed the guidelines for how governments should report fund balances.

The following chart presents unrestricted fund balance for FY2011 – FY2014. In this exhibit, the District’s net resources including self-imposed constraints amount to $351.7 million, or 6.5% of general fund expenditures in FY2014. These resources include those assigned for commitments and contracts, $87.1 million, and appropriated fund balance (the amount CPS plans to use to close its budget deficit), $267.7 million. From FY2013 to FY2014 the District’s ratio of Unrestricted General Fund Fund Balance to General Fund expenditures decreased by eleven percentage points. This huge drop in fund balance is due to the District's use of fund balance to close a deficit caused in part by the expiration of the partial pension payment holiday in FY2014.